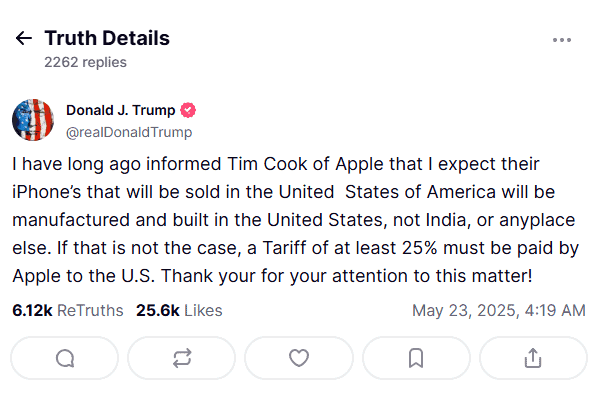

President Donald Trump’s recent threat to impose a 25% tariff on all iPhones not made in the United States has reignited debates about globalization, manufacturing, and the true cost of protectionist policy.

Announced via his Truth Social platform, Trump’s message was direct: if Apple continues to manufacture iPhones outside of the U.S.—specifically in countries like China and India—the company should prepare to pay steep import penalties. He singled out Apple CEO Tim Cook, urging the tech giant to “build in the U.S., not India, or anywhere else.”

Apple’s Global Supply Chain Isn’t Built Overnight

Apple’s iPhone production pipeline is a marvel of modern logistics. While the devices are designed in Cupertino, California, they are assembled predominantly in China and India using components sourced globally—from Japanese camera modules to South Korean memory chips. Foxconn and Pegatron, Apple’s primary assembly partners, run massive facilities in Shenzhen and Zhengzhou, with India’s Chennai-based factories quickly ramping up to meet growing demand.

These facilities aren’t just factories—they’re industrial ecosystems. Workers are trained to handle precision tasks at scale, parts suppliers cluster around them to minimize transit time, and component testing, assembly, packaging, and shipping are all tightly coordinated. Relocating that system to the U.S. would require rebuilding nearly every link in this chain from scratch.

Experts agree: it would take at least 5–10 years to build out the necessary domestic infrastructure and train a large enough U.S. workforce, particularly for roles involving micrometer-precision assembly. Not to mention, many of Apple’s suppliers, especially those making highly specialized components, have no presence in the United States.

What a 25% Tariff Could Do to iPhone Prices

A tariff of this magnitude would be passed directly to consumers, analysts say. Here’s how it could shake out:

- iPhone 16 Pro ($999 MSRP) → $1,250–$1,350 with tariffs

- High-end iPhone models → Prices could approach $1,800 or more

- Entry-level models (like the iPhone SE or 16e) → Could see a $150–$250 price hike

Apple may try to absorb some of the cost, but its hardware profit margins—already tighter due to component inflation and currency fluctuations—would take a hit. Apple’s lucrative services division (App Store, Apple Music, iCloud, etc.) wouldn’t be affected by tariffs, but the company’s core hardware business would face a significant squeeze.

The Political Angle and Potential Ripple Effects

Trump’s comments align with his broader “America First” economic platform. In his 2020 presidency and 2024 campaign rhetoric, he consistently promoted reshoring of manufacturing jobs. This iPhone tariff threat is one of the clearest examples yet of a targeted effort to force major U.S. companies to reconsider their overseas manufacturing strategies.

But the effects wouldn’t stop at Apple. If implemented, this policy would likely trigger a cascade of retaliatory trade measures and pricing increases across the tech sector:

- Samsung, Google, and OnePlus, which also rely on Asian assembly, could be next in the tariff spotlight.

- Accessory makers—AirPods, cases, chargers—would face similar pressure if assembled abroad.

- Component shortages could worsen if the geopolitical environment destabilizes supply routes.

Tech industry groups and economists have already voiced concern, noting that tariffs often backfire by raising costs for consumers and causing disruptions without achieving the desired domestic manufacturing resurgence. In 2019, a 15% tariff on Apple Watches, AirPods, and Macs was implemented during Trump’s trade war with China. Apple successfully lobbied for waivers, but the damage to investor confidence was felt immediately.

Apple’s Strategic Shifts—and Their Limits

To mitigate geopolitical risks, Apple has already moved roughly 10–15% of its iPhone production to India, with plans to increase that number over the next two years. Vietnam is absorbing production of accessories like AirPods and Apple Pencil, while Malaysia and Thailand have picked up some MacBook manufacturing.

But building in the U.S. still faces steep challenges:

- Labor Costs: Significantly higher than in Asia, particularly for large-scale manufacturing.

- Regulatory Complexity: U.S. environmental and labor regulations extend timelines for factory development.

- Skill Gaps: Many U.S. workers lack the specific micro-assembly skills that are abundant in China or India.

Apple has opened some U.S. facilities—like its Mac Pro factory in Austin, Texas—but these are symbolic compared to the scale needed for iPhones.

Market Reactions and the Road Ahead

Following the announcement, Apple’s stock dipped as investors braced for potential long-term consequences. Analysts noted that while Trump’s statement doesn’t represent immediate policy, it signals volatility that could drive preemptive price hikes or changes to Apple’s supply strategy.

If Trump regains the presidency in 2025 and follows through, this could represent the most aggressive use of trade policy against a single U.S. tech company in recent memory. Apple will likely accelerate its diversification strategy, but a full return to American manufacturing remains, at best, a decade away.

For consumers, this issue boils down to one thing: your next iPhone could cost a lot more—unless Apple finds a political or operational workaround to blunt the impact of a made-in-America mandate.

Apple vs Google vs Microsoft: A Comparative Analysis of Tech Giants in 2025

When it comes to tech giants, Apple, Google, and Microsoft shape our digital lives in countless ways. Each company brings something unique to the table – from sleek hardware to powerful software to innovative online services. The best choice between these three tech powerhouses depends on your specific needs, with Apple excelling in hardware integration, Microsoft dominating productivity software, and Google leading in online services and search.

These companies compete across many areas but also have their own strengths. Apple creates a seamless experience with its devices working together smoothly. Google offers free, easy-to-use tools that work on any device. Microsoft builds powerful software for work and school that many businesses rely on.

Your preference might depend on what matters most to you. Do you want devices that work perfectly together? Apple might be your pick. Need free tools you can use anywhere? Google has you covered. Looking for powerful software for work? Microsoft is hard to beat. Each company has loyal fans who stick with their favorite for good reasons.

Key Takeaways

- Apple offers the best hardware integration experience, while Google provides the most accessible cross-platform services, and Microsoft excels in business productivity tools.

- All three companies have different business models – Apple sells premium hardware, Google relies on advertising, and Microsoft balances software sales with cloud services.

- Your ideal tech ecosystem depends on your priorities like ease of use, price, cross-device compatibility, or specific work needs.

Historical Overview

The tech industry has been shaped by three major players – Apple, Google, and Microsoft – each taking unique paths to global influence while adapting to rapid technological changes and market shifts.

Apple’s Evolution

Apple began its journey in 1976 when Steve Jobs and Steve Wozniak built their first computer in a garage. The company struggled through the 1980s and 1990s despite introducing the Macintosh.

Apple’s true renaissance started when Jobs returned in 1997. The colorful iMac G3 helped save the company from near-bankruptcy. Then came the iPod in 2001, which revolutionized music consumption.

The 2007 iPhone launch marked Apple’s most significant turning point. This device changed how people interact with technology and put computing power in everyone’s pocket. The iPad followed in 2010, creating a new device category.

Under Tim Cook’s leadership since 2011, Apple has overtaken Microsoft in the computing market and become the first company to reach a $1 trillion valuation. The company shifted from being just a computer manufacturer to a hardware company with a robust ecosystem of services.

Google’s Growth

Google’s story began in 1998 when Stanford students Larry Page and Sergey Brin created a better search engine algorithm. Their PageRank system quickly outperformed existing search options.

The company went public in 2004 and used its new capital to expand beyond search. Gmail launched that same year, followed by Maps in 2005. Android, acquired in 2005, became their mobile operating system platform.

Google reorganized as Alphabet in 2015 to separate its core business from more experimental ventures. Throughout its growth, the company maintained its advertising-based revenue model, which still accounts for most of its income.

Security innovations became important to Google’s identity. The company introduced two-factor authentication in February 2011, ahead of both Apple and Microsoft. This focus on security helped build trust in their cloud-based services.

Microsoft’s Development

Microsoft dominated computing from the 1980s through early 2000s after Bill Gates and Paul Allen founded it in 1975. Windows and Office became essential software for businesses and homes worldwide.

The company’s business model centered on licensing fees for its software. This approach was hugely successful during the PC era, making Microsoft the most valuable company in the world by the late 1990s.

Microsoft faced challenges adapting to the internet and mobile revolutions. Their Windows Phone couldn’t compete with iPhone and Android. Internet Explorer lost ground to Chrome and other browsers.

Under Satya Nadella’s leadership since 2014, Microsoft pivoted to cloud services with Azure and subscription-based models like Microsoft 365. They also embraced open-source development and acquired strategic companies like LinkedIn and GitHub.

The transformation worked well. Microsoft recovered its market position and joined Apple in the trillion-dollar valuation club, proving its ability to evolve beyond its original strengths.

Business Models

Apple, Google, and Microsoft each pursue distinct business approaches that reflect their core values and market strategies. These tech giants have developed unique ways to generate revenue while maintaining competitive advantages in their respective domains.

Apple’s Ecosystem Approach

Apple focuses on creating premium hardware products that work seamlessly together within a closed ecosystem. The company generated $391.04 billion in revenue in 2024, primarily through device sales like iPhones, iPads, and Macs.

Unlike its competitors, Apple’s business model centers on high-margin hardware sales. The company designs both hardware and software, giving it complete control over the user experience.

Services have become increasingly important to Apple’s bottom line. Apple Music, iCloud, Apple TV+, and the App Store now form a substantial revenue stream.

Apple’s privacy-focused approach also sets it apart. The company emphasizes data protection as a selling point, positioning itself as the privacy-conscious alternative to ad-supported platforms.

Google’s Diversification

Google built its empire on advertising revenue, which remains its primary income source. The company offers many free services to collect user data that powers its targeted ad platform.

Search advertising forms the backbone of Google’s business model. When users search on Google, the company displays relevant ads based on search terms and user profiles.

Beyond advertising, Google has expanded into various technology sectors:

- Cloud computing with Google Cloud Platform

- Hardware with Pixel phones and Nest devices

- Subscription services like YouTube Premium and Google Workspace

Google’s parent company Alphabet serves as an umbrella for various ambitious projects. These “moonshot” initiatives explore new technologies that might become future revenue streams.

Microsoft’s Enterprise Focus

Microsoft has transformed its business model from primarily selling software packages to offering subscription-based services. The company generated $245.12 billion in revenue in 2024, with a strong focus on enterprise customers.

Microsoft 365 (formerly Office 365) exemplifies this shift. Instead of one-time purchases, customers pay ongoing subscription fees for access to Word, Excel, and other productivity tools.

Cloud computing has become central to Microsoft’s strategy. Azure, their cloud platform, competes directly with Amazon Web Services and Google Cloud.

Gaming represents another significant revenue source. Xbox consoles, game sales, and the Game Pass subscription service contribute substantially to Microsoft’s bottom line.

Enterprise software and services remain Microsoft’s strength. The company leverages its long-standing relationships with businesses to provide comprehensive IT solutions from operating systems to development tools.

Market Performance

The tech giants Apple, Google (Alphabet), and Microsoft show distinct financial patterns in their revenue generation, market valuations, and appeal to different investor profiles. Each company demonstrates unique strengths in how they capture market share and deliver returns.

Revenue Comparison

Apple generated $383.29 billion in revenue during fiscal year 2023, outperforming Alphabet’s $348.16 billion for fiscal year 2024. Microsoft trails behind these two in pure revenue numbers, but excels in other financial metrics.

The revenue sources differ significantly between these companies:

- Apple: Primarily hardware-focused with iPhone sales driving much of its income

- Google: Advertising makes up the bulk of its revenue stream

- Microsoft: More balanced between software licenses, cloud services, and hardware

Google recently showed impressive profit margins. In a recent quarter, Google achieved $17 billion in net profit from a gross profit of $23 billion, demonstrating strong cost management.

Market Cap Trends

The market capitalization race between these tech giants remains tight, with each company taking turns at the top spot. As of March 2025, these companies frequently trade places as the world’s most valuable public companies.

Key market cap trends include:

- Microsoft’s AI boost: The company’s early and substantial AI investments have helped drive its valuation upward

- Apple’s consistent strength: Despite slower innovation cycles, Apple maintains investor confidence through strong customer loyalty

- Google’s advertising dominance: The company’s core business remains highly profitable, supporting its valuation

Recent stock performance shows variance too. Apple delivered 33.23% year-over-year returns to investors as of February 2025, while Microsoft lagged significantly at just 0.07% in the same period.

Investment Strategies

Investors approach these tech giants differently based on their financial goals and risk tolerance. Each company offers distinct advantages.

Apple appeals to investors seeking:

- Stable growth with strong dividends

- Consumer brand loyalty

- Expanding services revenue

Microsoft attracts those interested in:

- AI-driven growth potential

- Cloud computing dominance

- Enterprise software market leadership

Google draws investors focused on:

- Digital advertising returns

- Diverse technological bets

- Strong profit margins

For balanced portfolios, many analysts recommend exposure to all three companies. Their different business models and revenue streams provide natural diversification within the tech sector.

Product and Service Offerings

Each tech giant offers unique products and services that shape how we interact with technology daily. Apple, Google, and Microsoft have built distinctive ecosystems that compete across multiple categories while maintaining their unique brand identities.

Operating Systems

The operating system battle continues to define these tech giants. Apple’s macOS and iOS offer a seamless experience across devices, focusing on simplicity and security. These systems are known for their polished interfaces and tight hardware integration.

Microsoft Windows remains the dominant desktop OS with approximately 75% market share. Windows 11 brings improved touch capabilities and Android app support, showing Microsoft’s commitment to cross-platform functionality.

Google’s Android powers over 70% of mobile devices worldwide, offering high customization but varying experience across manufacturers. Chrome OS, though less prominent, provides a lightweight alternative for education and basic computing needs.

Each company maintains strict control over their OS development, with Apple being the most closed ecosystem and Android offering the most flexibility for customization and third-party integration.

Mobile Devices

Apple’s iPhone continues to set industry standards with its premium build quality and powerful processors. The integration between hardware and software creates a smooth user experience that many competitors try to match.

The iPad dominates the tablet market with models ranging from budget options to professional-grade devices that rival laptops in performance.

Google’s Pixel phones showcase pure Android experiences with cutting-edge camera technology. While market share remains small, they influence Android development across all manufacturers.

Microsoft’s Surface line blends tablet and laptop functionality, with the Surface Pro and Surface Laptop targeting professional users. Their hardware focuses on productivity and creativity rather than mass consumer appeal.

Each company approaches hardware differently – Apple controls the entire stack, Google partners with manufacturers while producing premium examples, and Microsoft creates reference designs while licensing their OS to partners.

Cloud Services

The cloud services competition has intensified as businesses and consumers move more data online. Microsoft leads with Azure and Microsoft 365, offering robust solutions for enterprise customers. Their business focus gives them an edge in professional environments.

Google Cloud Platform provides strong data analytics and AI capabilities. Their consumer services like Gmail, Google Drive, and Google Docs boast over 1.5 billion users, making them the most widely-used productivity tools globally.

Apple’s iCloud focuses primarily on supporting their device ecosystem rather than competing directly for enterprise business. Services include:

- Device backup and synchronization

- Photos and file storage

- Email and calendar synchronization

- Family sharing options

All three companies offer basic free storage tiers with premium options, though Google and Microsoft provide more generous free allocations compared to Apple’s limited 5GB offering.

AI and Machine Learning

AI capabilities have become central to each company’s strategy. Microsoft has made significant investments in OpenAI, integrating ChatGPT technology across their product line. Their Copilot features now appear in Windows, Office, and Bing.

Google’s AI leadership shows in search, Google Assistant, and translation services. Their DeepMind division continues to make breakthroughs in research while practical applications appear across their product range.

Apple focuses on on-device AI with Siri and privacy-centered machine learning. Their approach prioritizes processing data locally rather than in the cloud, which offers privacy benefits but sometimes limits functionality compared to competitors.

The battle between these companies plays out prominently in voice assistants, automated features in productivity tools, and image recognition. Each company emphasizes different priorities:

- Microsoft: Productivity enhancement and business applications

- Google: Information access and service integration

- Apple: Privacy and seamless device experience

Consumer Base and Brand Loyalty

Apple, Google, and Microsoft each have built unique customer relationships over the years. Their success depends heavily on keeping users coming back.

Apple leads with remarkable customer loyalty rates. In 2021, their brand loyalty soared to 90.5% among consumers. Apple users often stay within the ecosystem, buying multiple products.

Google (Alphabet) tops many loyalty rankings. The company commands significant customer loyalty and consistently ranks high in consumer trust surveys.

Microsoft shows strong performance in the productivity space. A recent study showed that Microsoft dominates brand loyalty for productivity devices, with 76% of households owning at least one Microsoft-branded product.

Interestingly, brand crossover exists among these giants. Even among Apple users, Microsoft leads in brand loyalty globally.

Key factors driving loyalty for each company:

| Company | Key Loyalty Drivers |

|---|---|

| Apple | Design, ecosystem integration, status |

| Free services, search dominance, Android reach | |

| Microsoft | Office suite, Windows OS, business solutions |

Tech giants generally perform well in loyalty metrics. A Fortune 100 ranking showed Alphabet, Intel, Apple, Amazon and Microsoft all scored highly for customer loyalty.

The loyalty battle continues with each company using different strategies to keep users in their ecosystems.

Research and Development

Big tech giants pour billions into creating new technologies, with significant differences in their investment approaches and success rates in securing patents.

Innovation Investments

Apple, Google, and Microsoft have distinct strategies when it comes to R&D spending. Microsoft invested a hefty $27.57 billion in research and development, while Google’s parent company Alphabet spent a similar amount at $27.57 billion. However, Amazon tops both with a massive $42.74 billion R&D budget.

Apple takes a different approach. They spend only about 17% of their gross profit on R&D, which is substantially lower than their tech peers. This doesn’t mean Apple innovates less – they’re known for refining existing technologies rather than creating entirely new categories.

Google focuses on moonshot projects through their X Development lab, funding everything from self-driving cars to internet balloons. Microsoft balances practical software innovations with forward-looking research in AI and quantum computing.

Patents and Intellectual Property

The patent portfolios of these companies reflect their business priorities and innovation focus. Microsoft holds thousands of patents covering software, cloud computing, and hardware designs. Their intellectual property strategy supports both their product development and licensing revenue streams.

Apple’s patents often center on design, user experience, and hardware integration. They’re known for aggressively defending their intellectual property, engaging in high-profile legal battles with competitors like Samsung over smartphone designs.

Google secures patents across diverse fields including search algorithms, AI, and mobile technologies. They’ve adopted some open-source approaches, making certain patents freely available through initiatives like the Open Patent Non-Assertion Pledge.

Patent quality varies between companies. Apple typically files fewer patents but maintains a high-value portfolio. Microsoft and Google file more broadly, covering emerging technologies and defensive positions against competitors.

Strategic Alliances and Partnerships

The tech giants Apple, Google, and Microsoft have formed various strategic partnerships to strengthen their market positions. These alliances often cross competitive lines in surprising ways.

Apple and Microsoft have maintained an unexpected partnership since 1997 when Microsoft invested $150 million in Apple. Today, Microsoft Office apps run on Apple devices, while Apple’s iCloud and Apple TV+ services are available on Windows platforms.

Google pays Apple billions each year to remain the default search engine on iOS devices. This arrangement benefits both companies financially despite their fierce competition in other areas.

Microsoft and Google compete intensely, but they’ve collaborated on browser technologies and software standards. Their relationship is best described as competitive cooperation.

Each company has formed key hardware partnerships:

- Apple – partners with TSMC for chip manufacturing

- Microsoft – works with Dell, HP, and Lenovo for Surface and Windows devices

- Google – collaborates with Samsung and various OEMs for Android phones

In AI development, all three companies have distinct partnership approaches. Microsoft has invested heavily in OpenAI, while Google partners with research institutions. Apple tends to acquire smaller AI companies outright.

These strategic alliances allow each company to fill gaps in their capabilities. They can access new markets, technologies, and talent through these carefully structured partnerships.

Legal and Ethical Considerations

The tech giants Apple, Google, and Microsoft face ongoing scrutiny regarding their business practices. Each company has faced legal challenges and ethical questions that shape their corporate reputations and operations.

Antitrust Issues

All three tech giants have battled antitrust concerns. Microsoft faced a massive antitrust case in the 1990s when it nearly faced a breakup for its dominance in operating systems. The company eventually reached a settlement with the government.

Google has faced multiple antitrust investigations for its search engine dominance and advertising practices. In 2020, the U.S. Department of Justice filed a landmark antitrust lawsuit against Google, claiming it maintains an illegal monopoly.

Apple’s App Store policies have come under fire, with developers like Epic Games challenging its 30% commission fee. The EU’s Digital Markets Act now forces Apple to allow alternative app stores on iOS.

Recent court decisions suggest increased government willingness to regulate these tech powers and their market control.

Privacy and Data Security

The companies show marked differences in their privacy approaches. Apple positions itself as privacy-focused, using this as a competitive advantage against data-driven companies like Google. Their App Tracking Transparency feature lets users opt out of tracking.

Google’s business model relies heavily on user data collection for targeted advertising. This has led to numerous privacy controversies and regulatory fines, particularly in Europe under GDPR regulations.

Microsoft falls somewhere between, collecting user data while attempting to offer more transparency about these practices. All three companies face ongoing challenges with data breaches and security vulnerabilities.

Each has also faced criticism for compliance with government surveillance requests, raising questions about user privacy protections.

Employment Practices

Workplace culture and employment issues vary across these tech giants. Apple has faced criticism for working conditions in its manufacturing supply chain, particularly at facilities run by contractors like Foxconn.

Google has weathered employee protests over military contracts, sexual harassment policies, and claims of retaliating against worker organizers. In 2018, thousands of Google employees walked out to protest how the company handled sexual misconduct claims.

Microsoft has worked to improve its reputation after earlier allegations of a hostile work environment. The company now receives higher ethical ratings than its competitors in some evaluations, though problems persist.

All three companies continue to face challenges with diversity and inclusion, with critics noting the tech industry’s persistent gaps in representation of women and minorities in leadership roles.

Corporate Culture and Management Philosophy

Each tech giant has created a unique workplace culture that shapes how they innovate and compete in the market. These cultural differences reflect their founders’ visions and have evolved through various leadership transitions.

Leadership at Apple

Apple’s corporate culture centers on secrecy, innovation, and perfectionism. Under Steve Jobs, the company developed a demanding work environment where excellence was expected at all levels. Jobs was known for his exacting standards and sometimes harsh criticism of work that didn’t meet his vision.

Tim Cook’s leadership style differs from Jobs while maintaining Apple’s core values. He has created a somewhat more collaborative atmosphere while preserving the company’s focus on product excellence and design.

Apple operates with a relatively centralized decision-making structure. Teams work in “silos” with limited information sharing between departments. This approach helps protect intellectual property and maintains the element of surprise for product launches.

The company values deep expertise in specific areas rather than generalists. Apple employees often describe a culture where details matter and compromise on quality is rarely accepted.

Google’s Open Culture

Google built its culture on openness, collaboration, and employee empowerment. Unlike Apple’s secretive approach, Google encourages information sharing across teams. This open culture helps drive the company’s innovative spirit.

The famous “20% time” policy allowed employees to spend part of their workweek on personal projects. This approach led to the creation of Gmail, Google News, and other successful products.

Google’s workspaces reflect its culture with collaborative areas, fun elements, and perks designed to keep employees creative and engaged. The company pioneered many workplace benefits now common in tech, including free food, on-site services, and flexible work arrangements.

Leadership at Google tends to be less visible than at Apple. The founders, Larry Page and Sergey Brin, don’t have reputations for being demanding pedants like Jobs or Gates, preferring a more distributed leadership approach.

Microsoft’s Organizational Changes

Microsoft’s culture has undergone significant transformation throughout its history. Under Bill Gates, the company had a competitive, sometimes confrontational culture with strong divisions between teams. The “stack ranking” system that pitted employees against each other created internal competition.

When Satya Nadella became CEO in 2014, he worked to reshape Microsoft’s culture. His focus on growth mindset, empathy, and collaboration marked a dramatic shift from previous leadership approaches.

Microsoft now emphasizes its company values of respect, integrity, and accountability. The organization has become more flexible, better connecting its various divisions that previously operated almost as separate companies.

The shift toward cloud services and subscription models required cultural changes to support continuous improvement rather than periodic major releases. Microsoft has embraced open-source development and interoperability, representing a complete reversal from its earlier stance.

Compared to Apple and Google, Microsoft now positions itself as more focused on productivity and business applications, reflecting in its workplace culture and management approach.

Global Impact and Corporate Responsibility

Apple, Google, and Microsoft wield enormous influence globally through their environmental programs, social initiatives, and economic footprints. These tech giants have invested billions in sustainability efforts while also creating jobs and addressing social challenges.

Environmental Efforts

All three companies have made major climate commitments. Microsoft leads with its ambitious sustainability goals, pledging to be carbon negative by 2030. The company aims to remove all historical carbon emissions since its founding by 2050.

Apple has committed to complete carbon neutrality across its supply chain by 2030. They’ve already transitioned many facilities to renewable energy and reduced packaging waste significantly.

Google achieved carbon neutrality in 2007 and aims to operate on 24/7 carbon-free energy by 2030. Their data centers are among the most energy-efficient in the world.

Despite these efforts, a study by impak Analytics suggests these companies may fall short in some areas. The analysis shows that Apple, Alphabet and Microsoft fail to be true environmental leaders when evaluated beyond standard ESG metrics.

Social Initiatives

The social impact programs of these tech giants focus on education, diversity, and community support. Microsoft’s Skills Initiative has helped over 30 million people gain digital skills, with emphasis on underserved communities.

Google’s social programs include a $1 billion commitment to address housing shortages in California and various educational initiatives through Google.org.

Apple focuses on education through its Everyone Can Code curriculum and has strong supplier responsibility standards to improve worker conditions worldwide.

All three companies have faced criticism for not doing enough to combat misinformation and protect user privacy. Tech companies have special obligations to society, particularly to people who use their products and services.

Economic Influence

The economic impact of these tech giants extends far beyond their direct operations. Microsoft employs over 180,000 people worldwide and supports millions more jobs through its partner ecosystem.

Apple’s App Store has created a whole new economy, generating over $600 billion in billings and sales annually. The company supports over 2.7 million jobs in the US alone.

Google’s search and advertising platforms serve as critical infrastructure for millions of small businesses globally.

Despite their economic contributions, all three face ongoing scrutiny over market dominance and tax practices. Interestingly, these companies are often ranked among the top ESG companies by traditional metrics, though some analysts question these ratings based on broader impact assessments.

Frequently Asked Questions

Apple, Google, and Microsoft dominate the tech landscape with distinct approaches to products, services, and business strategies. Each company offers unique advantages and faces different challenges in today’s competitive market.

What are the differences between Apple, Google, and Microsoft’s ecosystems?

The ecosystems of these tech giants differ significantly in their focus and integration. Apple creates a closed ecosystem that tightly controls hardware and software, providing seamless integration but limited flexibility.

Google’s ecosystem centers on cloud services and data collection, making it highly accessible across devices. Their approach emphasizes free services supported by advertising.

Microsoft blends both approaches with strong enterprise solutions and increasing consumer focus. Their ecosystem works across various hardware platforms while maintaining good integration between services.

How do the business models of Apple, Google, and Microsoft compare?

Apple primarily generates revenue through hardware sales with high profit margins. Their focus on premium products allows them to maintain strong brand loyalty and recurring revenue through services.

Google’s model relies heavily on advertising revenue from their search engine and other platforms. They offer most services for free to collect valuable user data that fuels their ad business.

Microsoft has evolved to a subscription-based model with Microsoft 365 and cloud services. They balance enterprise solutions with consumer products, creating diverse revenue streams through software licenses and cloud services.

What are the comparative strengths and weaknesses of Google Workspace, Microsoft 365, and Apple’s productivity software?

Microsoft 365 excels in comprehensive business features and desktop applications. Its weakness lies in occasional complexity and a steeper learning curve for new users.

Google Workspace offers superior collaboration tools and cloud integration. However, it may lack some advanced features found in Microsoft’s offerings and works best with constant internet connectivity.

Apple’s productivity suite provides elegant design and seamless integration with Apple devices. Its main limitation is platform restriction and fewer advanced features for enterprise users.

How has the historical rivalry between Apple and Microsoft evolved with the entry of Google into the market?

The Apple-Microsoft rivalry began in the 1980s over operating systems and personal computers. This competition shifted when Google entered the market in the early 2000s.

Google’s rise forced both companies to adapt their strategies. Microsoft moved toward cloud services and subscription models, while Apple doubled down on premium hardware and services.

Today, the competition spans multiple fronts including cloud services, AI, mobile platforms, and productivity tools. The rivalry has become more complex with each company having distinct strengths in different market segments.

In terms of innovation and consumer satisfaction, how do Apple, Google, and Microsoft rank against each other?

Apple consistently ranks highest in consumer satisfaction due to product quality and customer service. Their innovation focuses on refining existing technologies rather than pioneering completely new ones.

Google leads in experimental innovation and new technology development. Their satisfaction ratings vary across products but remain strong for their core search and map services.

Microsoft has improved consumer satisfaction significantly under CEO Satya Nadella. Their innovation balances practical business applications with forward-thinking technologies like mixed reality and AI.

What are the implications of net worth and market capitalization differences among Apple, Google, and Microsoft?

Apple frequently holds the highest market capitalization, reflecting investor confidence in their premium pricing strategy and loyal customer base. This financial strength allows for massive R&D investments and strategic acquisitions.

Google’s parent company Alphabet maintains strong market value based on dominance in online advertising. Their diverse portfolio of experimental projects is supported by this financial cushion.

Microsoft’s steady growth in market cap demonstrates successful transition to cloud and subscription services. Their balanced business model provides stability while allowing investments in emerging technologies.