The global race for artificial intelligence dominance is entering a critical phase. Once considered years behind, China is now rapidly closing the gap with the U.S., thanks to aggressive domestic investments, hardware breakthroughs, and open-source LLM innovation.

While the U.S. still holds the edge in foundational models and chip technology, its advantage is narrowing—some officials estimate China is now just 3–6 months behind.

China’s AI Push: Closing the Gap

Huawei’s AI Chip Manufacturing: Limited but Growing

The U.S. Commerce Department estimates that Huawei will manufacture up to 200,000 advanced AI chips in 2025. While this is far below China’s internal demand, the effort signals a growing capacity. Huawei’s CEO Ren Zhengfei acknowledged that their Ascend chips trail Nvidia’s by one generation, but emphasized they are gaining ground through innovative clustering techniques and powerful model compression, all backed by a ¥180 billion ($25 billion) annual R&D war chest.

DeepSeek’s Open-Source Momentum

Startups like DeepSeek are proving that Chinese firms can punch above their weight in AI model development. Its DeepSeek-R1 and V3 models are freely available and deliver strong performance in both non-reasoning and reasoning tasks—posing a credible challenge to Meta’s Llama and Mistral’s open models. By pushing high-efficiency transformer architecture and lowering compute costs, DeepSeek is gaining support from research and developer communities worldwide.

Xpeng’s EV AI Chip Breakthrough

Chinese EV giant Xpeng recently launched the Turing AI chip, boasting 2,200 TOPS of computing power—outclassing Nvidia’s Orin-X (1,000+ TOPS). The chip is set to power Xpeng’s next-gen vehicles and will reportedly be integrated into Volkswagen’s China lineup, highlighting growing international confidence in Chinese silicon for automotive AI.

Massive Robotics & AI Investment

China also unveiled a ¥1 trillion (~$138 billion) fund dedicated to robotics and intelligent automation—one of the largest state-backed initiatives of its kind. This long-term investment underscores China’s bet that AI-infused robotics will be a cornerstone of its future industrial strategy.

The U.S. Response: Leading, But Cautious

Export Controls & Leaks

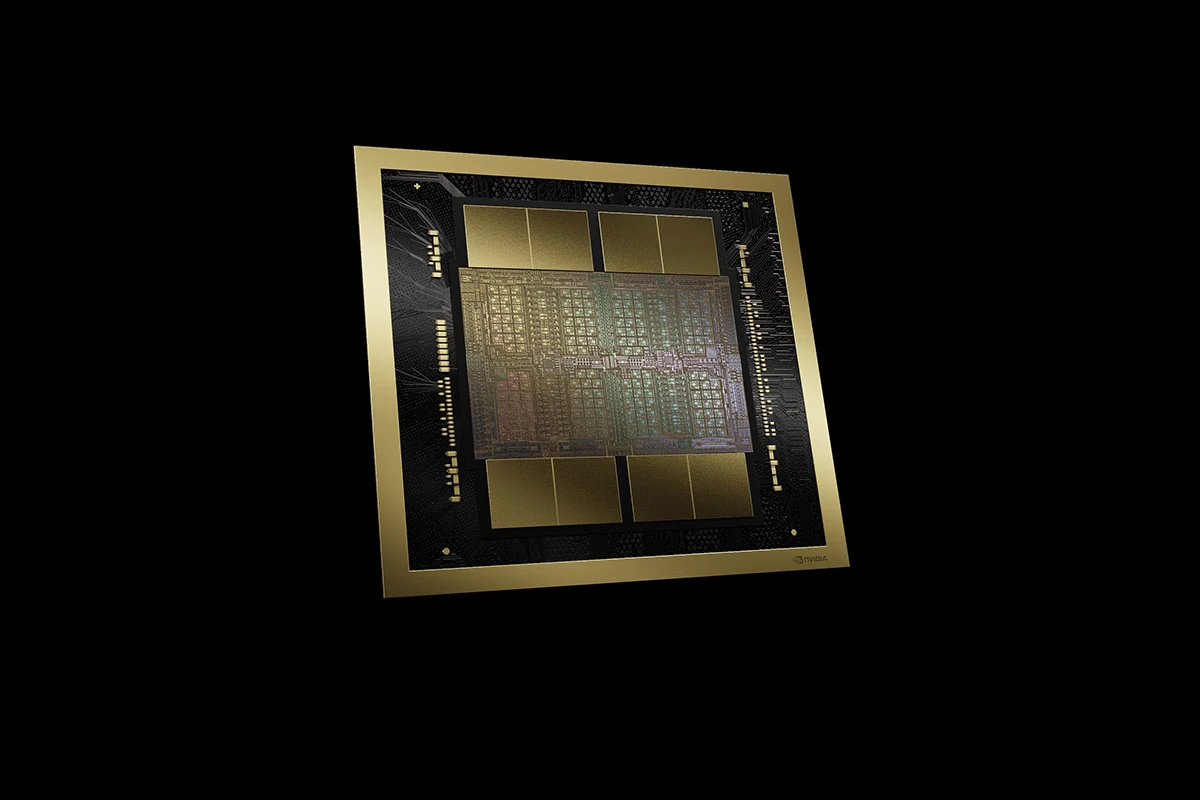

The U.S. continues to enforce strict export bans on advanced AI chips, including Nvidia’s H100 and A100. However, enforcement remains an issue—140,000+ U.S.-made chips reportedly entered China illegally in 2024, according to federal sources. These black-market chips are enabling workarounds that undermine American policy goals.

Official Alarm Bells

White House AI adviser David Sacks warns the lead over China may be shrinking fast, noting a 3–6 month gap at most. He suggests that excessive regulation and export crackdowns could inadvertently weaken U.S. innovation and allow China to thrive in a less-restricted, state-backed ecosystem.

Industry Skepticism Over Policy

Nvidia CEO Jensen Huang has openly criticized the restrictions, stating that if the U.S. pulls out of the Chinese market, Huawei will simply fill the vacuum. His concerns are echoed by Palantir CEO Alex Karp, who calls the AI race an “arms race” and says, “Either we win, or China will win.” He’s calling for a national AI strategy that combines investment with assertive global positioning.

Governance & AI Safety Diplomacy

As AI models approach Artificial Superintelligence (ASI), both nations face calls for diplomacy and global safety frameworks. U.S. and Chinese scholars alike are advocating treaty-style governance akin to nuclear nonproliferation agreements, but differing approaches to transparency and regulation may complicate cooperation.

U.S.–China AI Showdown: A Comparative Snapshot

| Category | China | U.S. |

|---|---|---|

| AI Chip Output | Huawei aims for 200k chips in 2025; 1–2 years behind in tech | Leading in GPU hardware (Nvidia); facing smuggling loopholes |

| Model Development | DeepSeek, MiniMax, Baidu gaining ground in open-source & efficiency | OpenAI, Google DeepMind, Anthropic lead in scale and innovation |

| Policy Approach | Aggressive state funding, indigenous focus, low regulation | Export bans, antitrust scrutiny, talent drain risk |

| Global Governance | Supports AI safety treaties but with limited transparency | Promoting global AI governance with democratic values |

Final Outlook: Two Superpowers on a Collision Course?

China’s strategy is long-term, well-funded, and increasingly effective. The combination of indigenous chip design, open-source innovation, and state subsidies is creating momentum that export bans alone may not stop. Meanwhile, the U.S. remains the leader in frontier model capability and foundational research, but internal regulation, IP restrictions, and brain drain could erode that edge.

As the AI arms race intensifies, the global community may soon need to reckon with not just who wins, but how to ensure safe, ethical, and globally coordinated development of transformative AI technologies.

More Details on China vs. USA

The race for AI dominance between China and the USA is intensifying, with both nations employing distinct strategies and facing unique challenges. Recent developments highlight China’s rapid progress and multifaceted approach, while the US focuses on private sector innovation and maintaining its lead in cutting-edge hardware and foundational research.

Latest Developments in the AI Race: China vs. USA

- China’s AGI Ambitions and DeepSeek: A recent report suggests China is on track to build “next-level” artificial general intelligence (AGI) infused with Chinese Communist Party values, potentially propelling it ahead of the US. China surprised the world in January 2025 by launching DeepSeek, a successful generative AI model that demonstrated strong performance with a fraction of the computing resources used by US models, significantly narrowing the AI performance gap.

- Multifaceted Approach and Real-World Deployment (China): China is pursuing multiple pathways toward AGI, including embodying AI algorithms in real environments. It is arguably further along in deploying AI in the real world for urban governance and is targeting five key areas for AI industry boost in Wuhan for 2025: AI plus robots, AI plus automobiles, AI plus PC and server, AI plus mobile phones, and AI plus eyeglasses.

- Hardware and Infrastructure: In May 2025, a consortium of Chinese companies launched the first 12 satellites of a planned space-based supercomputing platform for AI, Star Compute. While the US still holds a lead in advanced AI chips and computing centers (e.g., El Capitan at 1.7 exaflops), China is rapidly building out its infrastructure, including ultra-high voltage (UHV) transmission lines and green data centers to support AI growth.

- US Focus on Private Sector and Global Adoption: The US is emphasizing a private-sector-driven approach to AI innovation, with significant venture capital funding for AI startups. Microsoft President Brad Smith noted that the key factor in winning the AI race is whose technology is most broadly adopted globally. OpenAI’s “OpenAI for Countries” initiative, coordinated with the US government, aims to promote democratic AI rails as a contrast to potentially authoritarian Chinese versions.

- Export Controls and Geopolitics: The US has implemented stringent export controls on advanced AI chips to China, which has led to companies like Nvidia evaluating how to address the Chinese market. These controls are pushing countries to reconsider who owns their digital infrastructure and are forcing a binary choice between US and Chinese technology, though many countries are still attempting to hedge their bets. The Trump administration is reportedly planning to ease some of these restrictions.

- Talent and Research: China graduates significantly more STEM students annually (3.6 million vs. 820,000 in the US) and holds a large percentage of the world’s top AI researchers and patents. However, the US still leads in the quality of AI scholarly papers and the ability to move new ideas from universities to the private sector. China is actively working to reverse brain drain by offering incentives to Chinese-origin scientists to return home.

- Policy and Regulation: The US White House’s AI czar emphasizes letting the private sector “cook” without excessive regulation to maintain competitiveness. In contrast, China’s centralized, state-led approach allows for rapid scaling and deployment of AI solutions, often integrated into national policies and industrial plans, with a focus on surveillance and social management applications.

Comparison Table: China vs. USA in AI

| Feature | China | USA |

|---|---|---|

| Overall Approach | Centralized, state-led strategy with government support and integration into national plans. Focus on rapid deployment, practical applications, and achieving global leadership by 2030. Exploring multiple pathways to AGI. | Private sector-driven innovation, significant venture capital funding, and a decentralized ecosystem. Emphasis on cutting-edge research, foundational models, and global adoption of its technology. |

| Key Strengths | Vast data access (large population, less stringent privacy), rapid application and deployment at scale (smart cities, surveillance), strong government support and funding, large talent pool (STEM graduates, AI researchers, patents), focus on efficiency and lower cost models (e.g., DeepSeek). | Leading in breakthrough innovation, cutting-edge hardware (AI chips), strong university-to-private-sector pipeline, highest-quality AI scholarly papers, robust venture capital and private investment, strong focus on general-purpose AI technologies. |

| Areas of Growth/Focus | Next-level AGI, embodied AI, space-based supercomputing, AI + various industries (robots, automobiles, PCs, mobile phones, eyeglasses), large-scale infrastructure development (UHV lines, green data centers). | Frontier models, secure and responsible AI development, global partnerships for “democratic AI rails,” continued investment in advanced chip manufacturing and data centers. |

| Challenges | Dependence on foreign advanced chips (despite indigenous efforts), concerns about data security and government overreach, potential for stifled innovation due to centralized control and reliance on adapting existing technologies. | AI skills gap, potential for over-regulation stifling innovation, risk of losing ground in real-world deployment and application, ensuring global trust in its technology amidst geopolitical competition. |

| AI Model Performance | Rapidly narrowing the gap; DeepSeek R1 demonstrated strong results with less compute, shrinking the performance difference between top US and Chinese models from 103 points (Jan 2024) to 23 points (Feb 2025) on platforms like LMSYS’s Chatbot Arena. | Historically outperformed, but the gap is closing. Still leads in breakthrough innovation and complex, large statistical models (e.g., OpenAI’s ChatGPT). |

| Global Strategy | Aggressively spreading low-cost, open-source AI models globally, embedding its tech in emerging markets, leveraging economic and diplomatic ties for technology adoption. | Promoting “democratic AI rails” and urging countries to choose its technology over Chinese offerings, using export controls to limit Chinese access to advanced tech, engaging in “charm offensives” with allies. |

Export to Sheets

The “Race for AI” is not just about technological advancement but also about geopolitical influence and the shaping of future digital infrastructure and governance. Both nations are formidable competitors, and the coming years will likely see continued intense competition and strategic maneuvers. Sources

iPhone Features and Exclusions By Global Region

iPhones offer different features across regions due to varying regulations, partnerships, and infrastructure requirements. Many exclusive iPhone features remain limited to the United States, including Apple Card, Advanced Data Protection, and select Apple Wallet capabilities.

The regional differences in iPhone features affect millions of users worldwide. Apple continues to expand feature availability gradually, with some U.S.-exclusive functions planned for international rollout in future iOS updates.

Apple’s credit card management through the Wallet app stands out as a prime example of U.S.-exclusive functionality since its 2019 launch. The physical and digital Apple Card provides users with cashback rewards and seamless integration with iOS devices.

While iPhones aim for a consistent global experience, there are indeed some features that are exclusive to the United States, or have limitations in other regions due to local regulations, partnerships, or infrastructure. Here’s a breakdown of common differences:

Features often exclusive to the US (or with limited availability elsewhere):

- Financial Services:

- Apple Card: This credit card, managed through the Wallet app, and its associated high-yield Apple Card Savings account are currently only available in the United States.

- Apple Cash: A peer-to-peer payment service integrated with Messages and Wallet, similar to Venmo, is also US-exclusive for now.

- Apple Pay Later: This “buy now, pay later” service, allowing users to split purchases into interest-free payments, has also been a US-only feature.

- Identification and Security:

- Wallet IDs: The ability to add driver’s licenses or state IDs to Apple Wallet for digital identification is gradually rolling out across US states and is not widely available internationally.

- Roadside Assistance via Satellite: While Emergency SOS via Satellite has expanded, the direct “Roadside Assistance via Satellite” feature was initially a US-exclusive for iPhone 14 and 15 models.

- Clean Energy Charging: This feature optimizes charging times based on when the power grid is using cleaner energy sources and is currently available only in the US.

- 5G Technology:

- mmWave 5G: US iPhone models often support millimeter-wave (mmWave) 5G bands, which offer extremely fast speeds but have a shorter range. Many international versions of iPhones do not include mmWave antennas, supporting only sub-6 GHz 5G, which has broader coverage but is slower. This can affect battery life as well, as mmWave can be more power-intensive.

- Specific iOS Features:

- Apple Intelligence: While rolling out, certain Apple Intelligence features are initially limited to users outside the EU and China, and only on iPhone 15 Pro, Pro Max, and the iPhone 16 lineup. This can include features like the AI-powered emoji generator (Genmoji).

- Call Recording and Transcription: Recent iOS updates have brought call recording and transcription to iPhones, but availability might be region-specific due to privacy regulations.

Features with Regional Restrictions (outside the US):

- Camera Shutter Sound: In countries like Japan and South Korea, iPhones are legally required to produce an audible shutter sound when taking photos, and this cannot be silenced, even if the phone is set to silent mode. This is often tied to the local SIM card or network.

- FaceTime: In some countries, particularly in the Middle East, FaceTime may have restrictions. For example, some regions might allow FaceTime video calls but block audio calls.

- Dual Physical SIM: While most iPhones globally use a combination of one physical SIM and an eSIM, iPhones sold in mainland China, Hong Kong, and Macau often come with dual physical SIM card trays.

- Apple Services Availability: Certain Apple services like Apple Arcade, Apple News, and Apple TV+ might have limited content or be completely unavailable in some countries due to local regulations and censorship.

It’s important to note that feature availability can change over time as Apple expands services or as regulations evolve. If you’re purchasing an iPhone internationally, it’s always advisable to check the specific model and its supported features and bands for your region of intended use, and be aware that the warranty is typically only valid in the country where the device was originally sold.

Key Takeaways

- Several premium iPhone features remain exclusive to U.S. users in 2025

- Regional regulations and partnerships determine feature availability

- International users can expect gradual rollout of select U.S. features

Exclusive iPhone Features Outside the US

International iPhone users access several features and capabilities that differ from U.S. models, ranging from hardware options to regional software adaptations. Physical SIM support, expanded payment systems, and market-specific services create distinct experiences for users worldwide.

Global Software Variations

iOS offers region-specific features tailored to local markets. International versions support multiple language variants beyond US English, with specialized keyboard layouts and input methods.

Apple Intelligence will expand beyond U.S. English in iOS 18.2, adding support for additional English variations. The update introduces Genmoji and ChatGPT integration for international users.

Advanced AI features require specific hardware – iPhone 15 Pro or Pro Max, or iPads with M1 chips or newer.

Unique Hardware Attributes

International iPhone models maintain physical SIM card trays alongside eSIM support, offering greater flexibility for travelers and dual-SIM users.

Models in mainland China, Hong Kong, and Macao come with dual physical nano-SIM slots due to government regulations.

Users can operate two different phone lines or data plans simultaneously, though carrier-locked devices limit plan options.

Payment and Wallet Diversifications

International markets use diverse payment systems adapted to local preferences and regulations.

The Apple Card remains U.S.-exclusive, prompting international markets to develop alternative digital payment solutions.

Many regions offer country-specific digital wallet integrations, contactless payment systems, and peer-to-peer money transfer options.

Health and Accessibility Features

Health tracking capabilities vary by region due to different medical standards and regulations.

Some markets offer expanded health data integration with local healthcare providers.

Blood glucose monitoring and lab result interpretations adapt to regional measurement units and medical terminology.

Regional Services and Language Options

Apple Maps provides enhanced coverage in specific regions with detailed transit information and congestion zone alerts.

Local news services and Apple News Audio content vary by market.

Siri supports region-specific commands and local service integrations.

Developer and Beta Access

Beta program availability and developer resources differ across regions.

Some markets receive early access to feature testing based on local regulations and market priorities.

International developers often access market-specific APIs and tools for regional app optimization.

Frequently Asked Questions

Regional differences affect iPhone feature availability across countries, with US models having exclusive access to certain capabilities including payment services, emergency features, and select iOS functions.

What are the differences between US iPhones and international models?

US iPhones support mmWave 5G networks, while international models typically only support sub-6GHz 5G.

The US models include specific emergency calling features and satellite connectivity options not available in other regions.

US iPhones also come with CDMA network compatibility, which most international models lack.

Which iOS 18 features are unavailable outside the United States?

Apple Card integration and related financial services remain exclusive to US users.

Certain AI-powered features in iOS 18 will launch first in the US before rolling out to other regions.

Emergency SOS via satellite maintains US-only availability in the initial release phase.

Are there any location-based restrictions for features on the iPhone?

Maps navigation features vary by region, with certain detailed views limited to US locations.

Apple Pay and wallet features have different merchant support depending on the country.

Some Siri capabilities and voice recognition features work only with US English.

How does changing the region on my iPhone affect available features?

Changing the region settings modifies the App Store content and available applications.

Payment methods and Apple ID restrictions apply based on the selected region.

Some features automatically disable when switching to non-US regions.

Can features exclusive to US iPhones be enabled in other countries?

VPN services do not bypass regional restrictions for US-exclusive features.

Hardware-specific features tied to US models remain unavailable on international devices.

Software limitations are enforced through Apple ID location verification.

What are the implications of using an iPhone intended for the US market in another country?

Warranty service may be limited or unavailable outside the US.

5G band compatibility issues can affect network performance in different regions.

Certain emergency services and location-based features may not function correctly abroad.