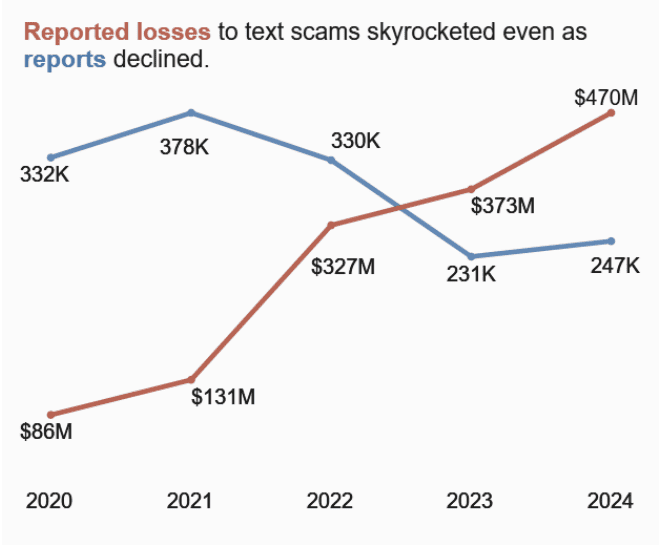

Scammers are now targeting your phone more than ever—and it’s costing Americans hundreds of millions of dollars. In a new report from the Federal Trade Commission (FTC), text message scams surged again in 2024, racking up a jaw-dropping $470 million in reported losses. That’s nearly $100 million more than 2023 and five times higher than losses reported just four years ago.

While robocalls and phishing emails have long been cybercrime mainstays, scam texts—also known as “smishing”—have quietly become one of the most profitable weapons in a scammer’s arsenal. And unlike spam calls, scam texts often look legitimate. A fake bank alert, a delivery issue, or even a phony job offer can trick even savvy smartphone users into tapping a malicious link or replying with sensitive information.

The Rise of Smishing: Why It’s Getting Worse

What’s especially concerning about this year’s FTC data is that the number of scam reports has actually declined—but the amount of money lost has ballooned. That suggests that scammers are getting better at targeting victims who are more likely to fall for high-dollar cons.

Part of this trend may be due to new technologies like AI-generated text, spoofed phone numbers that appear local or familiar, and automated systems that can churn out millions of messages per day. And while telecom providers have made strides in filtering out spam, scam texts continue to slip through—often disguised as legitimate alerts.

Top Scam Texts in 2024

According to the FTC, the most successful text scams of 2024 followed a few familiar—but increasingly sophisticated—templates:

- Fake Package Notifications

You get a text saying your package is delayed or undeliverable, with a link to “resolve the issue.” Clicking it can install malware or lead to phishing sites that steal credit card data. - Phony Job Offers

These often involve fake “task-based” remote jobs that seem too good to be true. After completing a few “assignments,” the scammer asks for bank info or payment for training materials. - Bogus Bank Alerts or Fraud Warnings

Messages posing as fraud alerts from your bank or credit card company are crafted to incite panic—just enough to get you to click a link or call a fake number. - Unpaid Toll Notifications

A fast-growing scam in 2024, victims receive a message saying they owe money for a missed toll. The link typically leads to a fake DOT payment site. - “Wrong Number” Texts That Turn into Romance Scams

A casual “Oops, wrong number” evolves into a friendly chat—then a romantic connection—before the scammer shifts the conversation to investment schemes or urgent money requests.

Real People, Real Losses

Victims range from tech-savvy young adults to older adults living on fixed incomes. In some cases, retirees have been conned out of life savings. One of the most devastating types of scams this year involves investment cons that originate through innocent-looking texts. According to FTC analysts, the average loss for this scam type is well over $7,000 per victim.

How to Protect Yourself Right Now

If you’re receiving weird or unexpected texts, don’t ignore the risk. Here are the FTC’s top tips:

- Don’t Respond or Click: Even replying “STOP” confirms your number is active and can lead to more texts.

- Don’t Trust Caller ID: Scammers can spoof real phone numbers.

- Use Built-In Spam Filters: Both Apple’s iMessage and Google Messages now include options to report spam texts directly.

- Forward Scam Texts to 7726 (SPAM): This helps carriers identify and block scam campaigns.

- Report It: Submit scam texts to the FTC at ReportFraud.ftc.gov so they can track trends and take action.

The Bottom Line

Text scams are no longer small-time fraud—they’re a big business costing Americans nearly half a billion dollars a year. And until regulation and technology catch up, the best protection remains awareness. Always question unexpected texts, avoid clicking links, and help others—especially older family members—understand the risks. One careless tap could be all it takes to get scammed.

Key Takeaways

- Text scams cost U.S. consumers $470 million in 2024.

- The amount lost to scams increased by almost $100 million from 2023.

- The problem with text message fraud continues to get worse.

FTC Reports $470M Lost to Text Scams in 2024

Text scammers stole $470 million from U.S. consumers in 2024. New tactics, smarter tricks, and broader targets helped push these losses nearly $100 million higher than last year.

Year-Over-Year Comparison: 2023 vs. 2024

In 2023, reports to the Federal Trade Commission (FTC) showed losses of $373 million due to text scam schemes. In just one year, losses jumped to $470 million, marking a sharp increase of almost 26%. The FTC’s tracking reveals that text-based fraud is growing much faster than most other digital scams.

Below is a simple table for comparison:

| Year | Total Losses | Increase Over Previous Year |

|---|---|---|

| 2023 | $373 million | — |

| 2024 | $470 million | +$97 million |

Text scams now make up a larger share of all consumer fraud losses, which signals that criminals are getting better at tricking people through their phones.

Reasons Behind the Surge in Text-Based Fraud

Several key trends helped drive the spike in scam losses. The main reason is the use of automated tools. Scammers can now send out thousands of fake messages in seconds, reaching more people than ever before.

Criminals copy real business names and use urgent messages. Many texts appear to be from banks, delivery companies, or government agencies. These fake texts ask people to click on links or give out personal information fast. People trust their phones, so they act before checking for signs of a scam.

Another factor is the use of personal data from past data breaches. The scammers use facts like a person’s address or last four digits of a bank account to make the texts look real.

Demographics Most Affected by Text Scams

Adults of all ages are targets, but people ages 20 to 49 report losing money most often. Reports show that young adults tend to respond more quickly to text messages. The high use of smartphones in this group makes them easier for scammers to reach.

However, people age 60 and over lose more money per incident. This group often suffers bigger losses because scammers trick them into sending large payments or giving up sensitive banking information. Teens and those over 65 are less likely to report, but researchers believe scam losses in these groups are undercounted.

The FTC warns that no age group is entirely safe from these attack methods. Scammers target anyone who uses a smartphone, often using different tactics for different age ranges.

Rising Threat and Future Outlook

Scam text messages are tricking more people and leading to higher losses each year. The techniques and tools scammers use keep getting more advanced, making it harder for people to stay safe.

Emerging Scam Tactics Driving Losses

Scammers use fake delivery updates, bank alerts, and emergency messages to grab people’s attention. They often make their texts look real by copying logos or using urgent language. Some trick people into clicking harmful links that steal personal information.

A new method involves spoofing phone numbers, so the scam texts appear to come from trusted sources like banks or package carriers. Scammers also use personal details found online to make their messages sound more convincing. This can make it tough for people to tell what is real and what is not.

Simple warnings may no longer be enough. People need to watch for small signs, like grammar mistakes or odd web links, to avoid these traps.

Measures for Consumer Protection Against SMS Scams

The Federal Trade Commission (FTC) urges people to never share personal info, passwords, or payment details by text message. If people receive a message from a company or bank asking for such details, they should contact the business using a verified number, not the one in the message.

Some mobile carriers offer free spam filters or scam-blocking tools. Users can report scam texts by forwarding them to 7726 (SPAM). This helps carriers block future scam numbers.

Tips for staying safe:

- Double-check suspicious messages.

- Avoid clicking on links from unknown senders.

- Use strong, unique passwords.

- Keep phone software updated for the latest security patches.

Role of Technology in Detecting and Preventing Scams

Technology helps spot scam texts before they reach phones. Many mobile carriers use machine learning tools to find and block suspicious messages. These tools scan for patterns such as similar text or web links seen in known scams.

Banks and apps now use two-factor authentication to keep accounts safer. This means scammers need more than just a password to get in. However, tech alone cannot solve everything.

People still play a big part by being cautious and reporting strange messages. Technology and public awareness together offer the best chance to cut losses from text scams.

Frequently Asked Questions

Text scams have cost consumers hundreds of millions of dollars, with new methods making it easier for scammers to trick people. The FTC and other agencies are working quickly to respond, but individuals also need to know how to protect themselves and what steps to take if targeted.

How can consumers protect themselves against text scams?

People should not click on links from unknown numbers or reply to suspicious messages. Verifying any requests by contacting companies through official websites or phone numbers can help prevent scams.

Enabling spam filtering and reporting suspicious texts to their phone carrier increases safety. Keeping devices updated also closes security gaps.

What are the most common types of text scams recently reported?

Fake package delivery notifications, bank alerts, and urgent requests for payment are some of the most reported schemes. Scammers pose as official companies or government agencies to collect money or personal information.

Some text scams may offer fake prizes or ask for login credentials, catching people off guard.

What should be done if one falls victim to a text scam?

Victims should contact their bank or credit card company right away if they provided any financial information. Changing passwords and monitoring accounts for unusual activity is important.

Reporting the scam to the FTC and local authorities can also help limit further damage.

What measures are being taken by the FTC to combat the rising text scam cases?

The FTC investigates scam reports and uses the information to warn others and stop scammers. They also work with phone companies to block suspicious numbers and encourage stronger protections.

Public awareness campaigns aim to teach people how to spot scams and avoid losses.

How can individuals report text scams to the authorities?

Anyone who gets a scam text can report it to the Federal Trade Commission online. Many phone carriers also allow reporting by forwarding the message to 7726 (SPAM).

Local law enforcement may also take reports for record-keeping and investigations.

Are there any new regulations in place to deter text scam activities?

Several new rules limit robocalls and spam texts, giving regulators more power to fine or shut down offenders. The FCC works with the FTC to enforce these regulations.

Ongoing efforts look to strengthen privacy standards and make it harder for scammers to reach new victims.